An Overview of where Apollo deposits come from

What is Apollo DAO?

Apollo DAO is a recent protocol launched on Terra. The protocol has 2 major components to it - the DAO overlooking the protocol’s warchest capital and protocol site where users have access to optimize their yields through auto-compounding or simply access to superior yield farming strategies.

Recently, the protocol launched a Community Farming event to bootstrap liquidity on the protocol and to also distribute its native token $APOLLO whereby a portion of the yields from the LP farms are used to purchase $APOLLO.

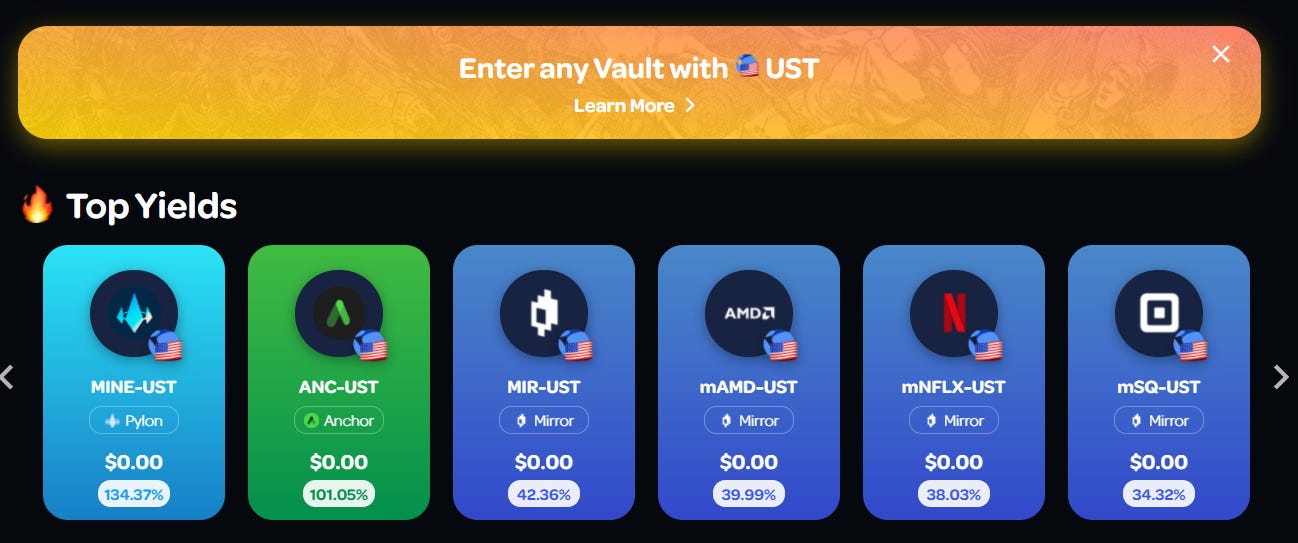

To date, Apollo has a TVL of $173M across all of the vaults. But where does this capital come from? In this article, we’ll explore some possible theories as to where Lunatics are deploying these capital from.

First, some Apollo Vault metrics

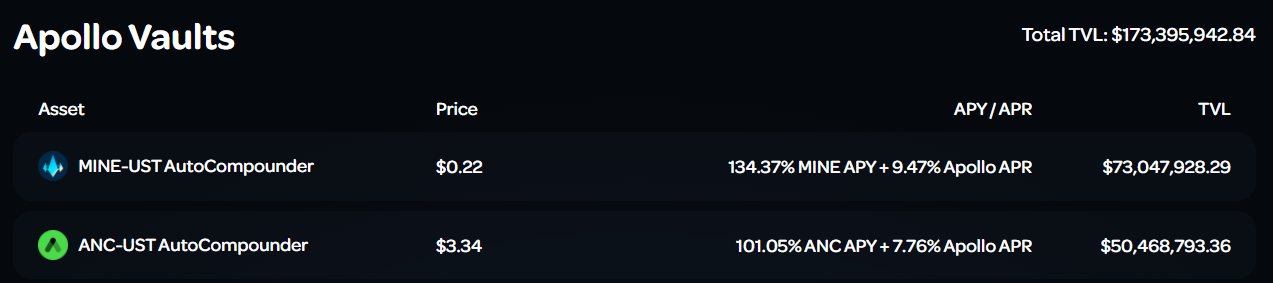

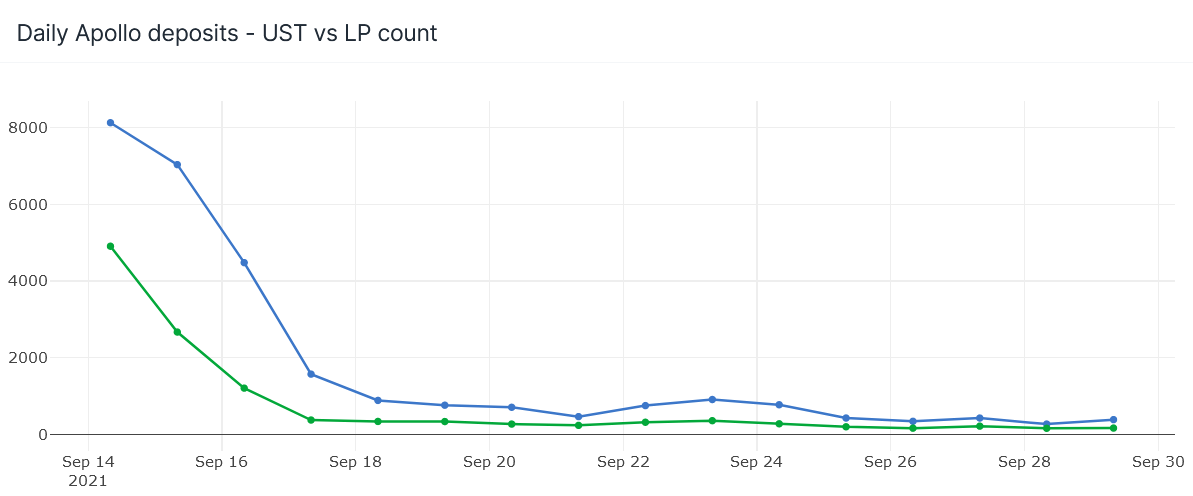

There are 2 ways to deposit into Apollo vaults. You can either deposit UST and the protocol would automatically use half to purchase the other asset of that LP, or you can provide an LP position directly. Graph below shows the number of times UST (in blue) is deposited vs an LP deposit (in green).

We see on the day of the launch, there were about 13k deposit transactions coming into Apollo, 8k transactions from UST and 5k transactions from LP positions. Throughout the days to follow, UST deposits stay consistently higher than LP positions. How much higher you may ask?

Well, about 70% UST : 30% LP higher.

Depositing into vaults using UST directly is clearly the preferred method as daily UST deposit counts are 2 times more than LP deposit counts.

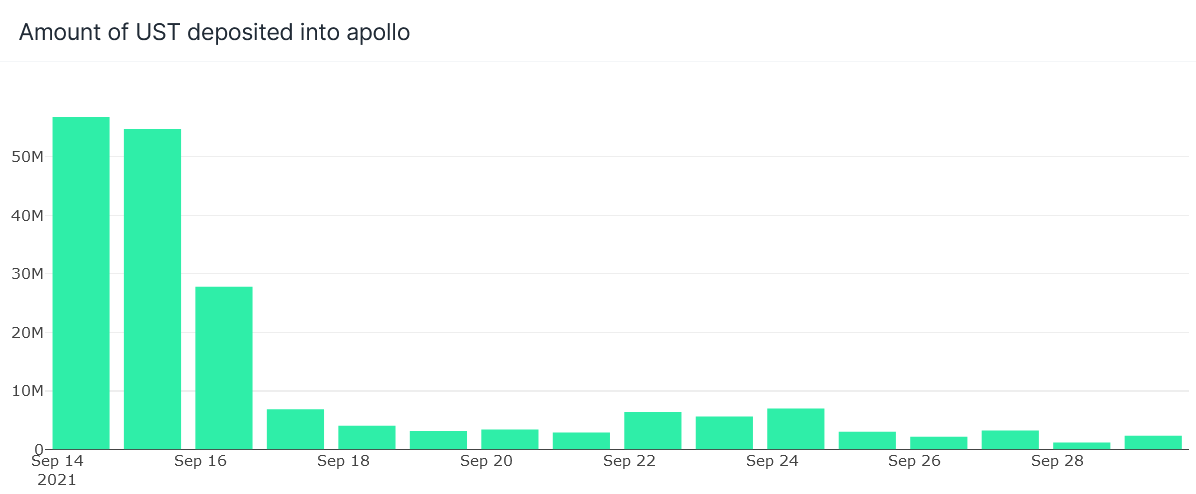

If we look at the amount of UST deposited, the first few days of Phase 1 launch saw the most deposit activity where more than 130M UST was deposited in just the first 3 days. In about 15 days since the community farming event launched, a total of 190M UST was deposited (not counting UST that is withdrawn).

Theories on capital movements

Given all these volume coming in, where do they actually come from? To answer this, I will look at deposit theories for UST, MINE and ANC. I decided to include MINE and ANC since they represent the current top 2 pool by total value locked.

Theory 1: UST is coming from Anchor deposits

The first theory for UST is that people park their spare UST in Anchor to wait for better opportunities like the community farming event. When these events happen, people withdraw UST out of Anchor to deposit into these events.

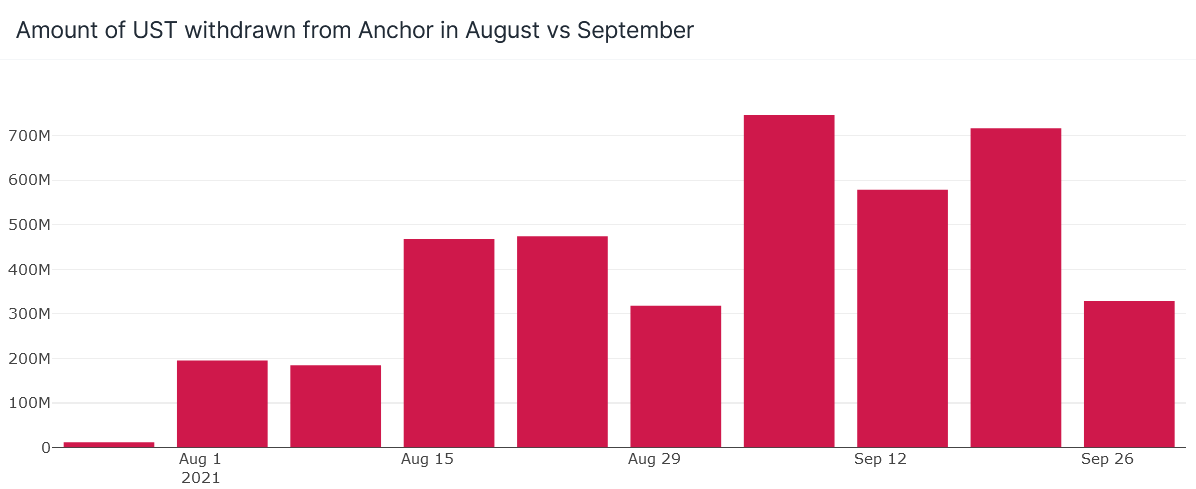

From the graph above, we do see an increase in the UST withdrawn from Anchor near the launch date of Sept 14 as compared to the UST withdrawals in August.

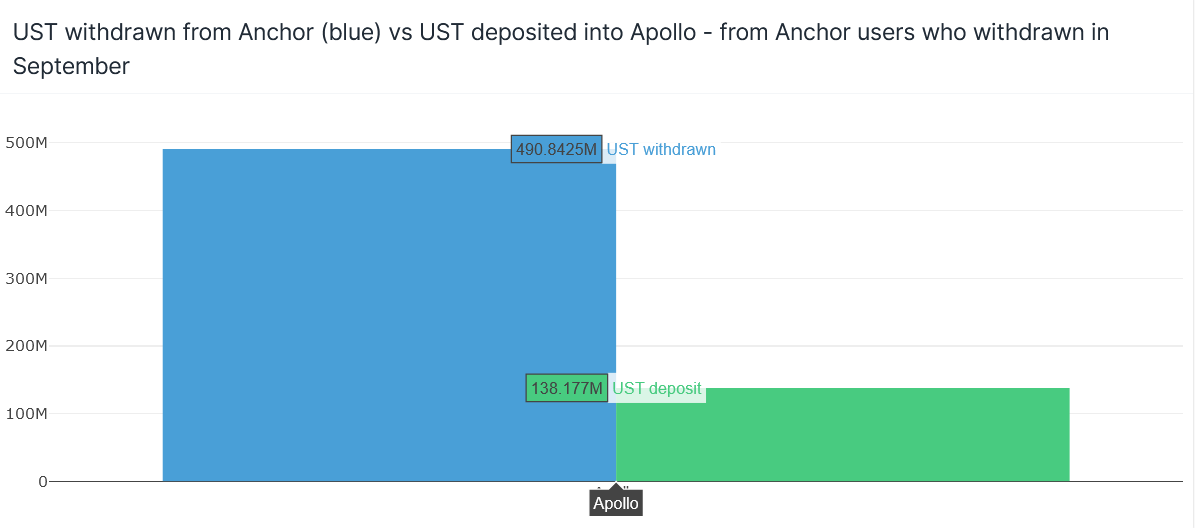

To investigate this further, I asked the question of - ‘for users who withdrawn UST from Anchor, how much UST did they deposit into Apollo?’

From the above, we see that UST deposited into Apollo is only about a quarter of the total UST withdrawn from Anchor. From this, it doesn’t seem like Apollo was a major factor for the UST withdrawals.

We see a more convincing trend when we look at the number of people. On the right we have the number of users who deposit UST only into Apollo which is about 10.8k users. On the left, we have users who withdrawn UST from Anchor and subsequently deposited UST into Apollo, which is 4770 users, which is about 44% of total Apollo UST depositors.

Although the volume of UST is not convincing, the number of users who withdrawn UST from Anchor and subsequently deposit into Apollo is quite high.

44% of users who directly deposited UST into Apollo in September had withdrawn UST from Anchor in the same month.

Verdict about Theory 1: UST is NOT primarily coming from Anchor withdrawals

28% of UST withdrawn from Anchor in September is deposited into Apollo vaults. —> Volume tells us that Apollo is not that the primary driving factor

44% of users who deposited UST into Apollo had withdrawn UST from Anchor.

Although almost half of Apollo depositors had withdrawn UST from Anchor in the same month, I wouldn’t say UST is primarily coming from Anchor (only 28%).

UST could be coming from existing balance in wallets.

Theory 2: MINE-UST LP deposits is coming from people who unstake MINE from governance

My theory is that besides unstaking the MINE-UST LP from Terraswap or Pylon, there is substantial amount of people who unstaked MINE from governance to provide as LP to the MINE-UST Apollo vault.

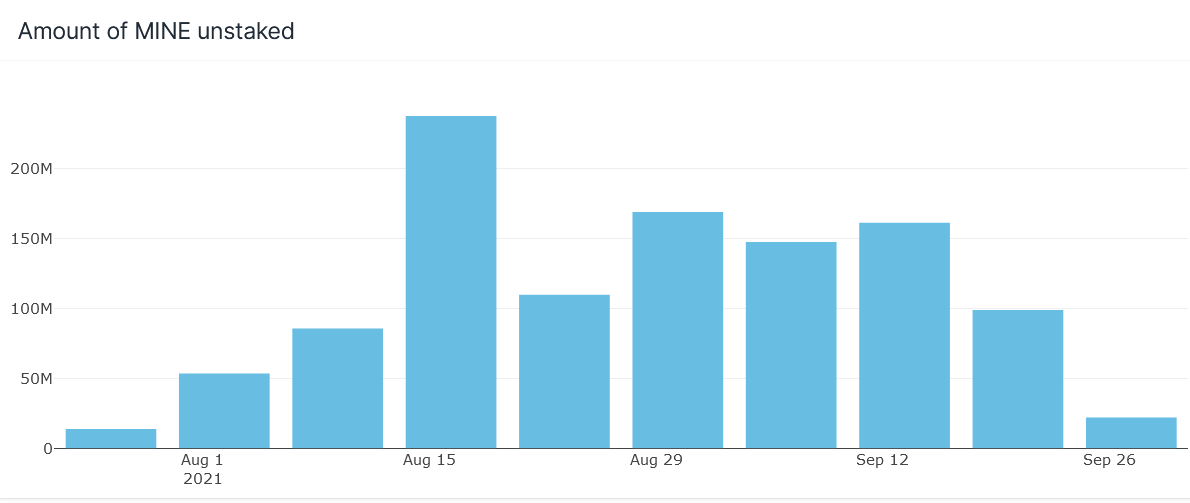

To test this theory, we first look at the weekly volume of MINE unstaked leading up to the vault opening on September 14.

We see a gradual increase in the amount of MINE unstaked since August and a steady weekly volume of 150M MINE unstaked per week from Aug 29 - Sept 12.

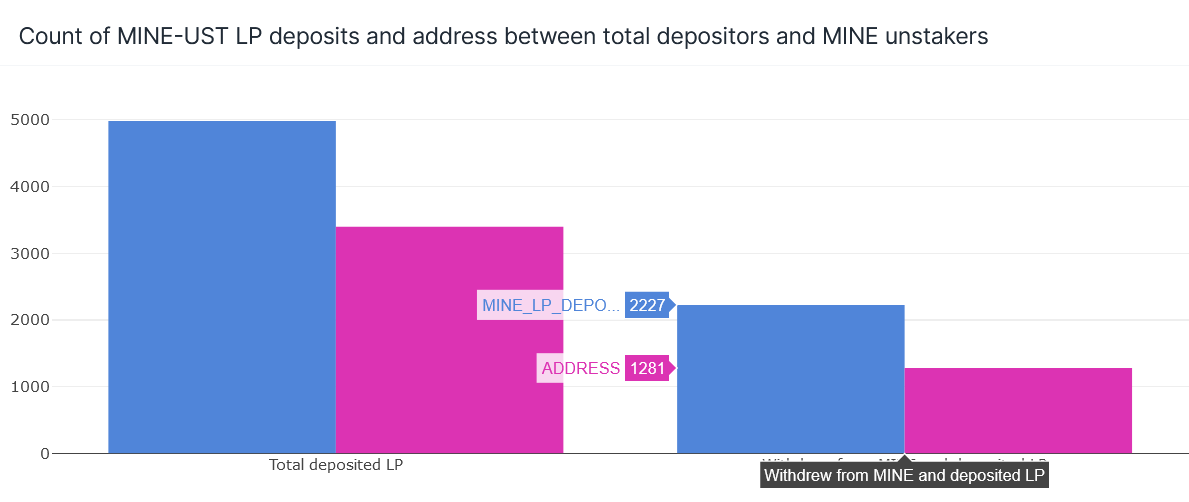

To be certain, I looked into the overlap between MINE unstakers and MINE-UST LP depositors. In the graph below, the left side represents the total MINE-UST LP depositors while the right side represents people who unstaked MINE and also deposited into that LP (let’s call these group the overlappers).

Let’s focus on the blue graphs first. The blue is representing the number of MINE-UST LP deposit transactions that occured. We see the overlappers ccontributed 45% of total LP deposit transactions.

The purple portion shows the number of addresses. Here, overlappers make up 38% of total depositors.

Both of these insights tell me that a substantial amount of MINE-UST LP deposits are actually coming from MINE that is unstaked from governance since 45% of the transactions come from people who have unstaked MINE and deposited the LP.

Based on this, I think the verdict for Theory 2 that MINE-UST LP deposits also come MINE unstaked makes sense. If we think about where the LP deposits could come from, really it’s either existing MINE-UST LP positions or creating a new LP position.

I would say Theory 2 would be disproven if we saw volume of MINE unstaked to be low and the number of people who had unstaked MINE and deposited into Apollo is also low. However, this is not the case - in fact, the opposite happened which is why I think Theory 2 holds to some extent.

Theory 3: ANC-UST LP deposits is coming from people who unstake MINE from governance

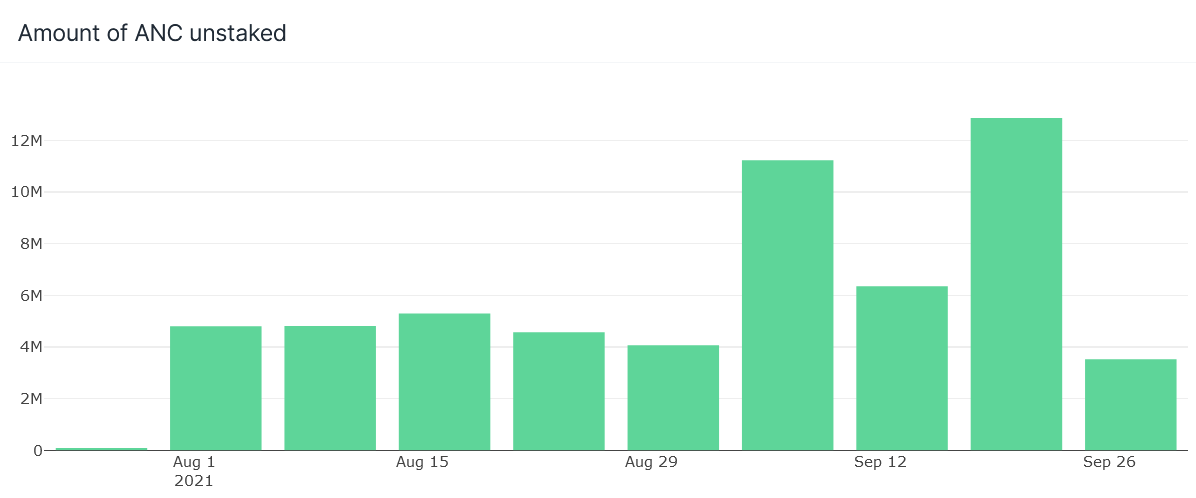

Similarly, I’m also hypothesizing that the ANC-UST LP deposits, besides coming from existing LP positions, also come from ANC that is unstaked from governance for this purpose.

The trend for ANC unstaked here is much more visible as compared to MINE unstaked. We see that the weekly ANC unstake is constant at 4M ANC tokens in the weeks leading up to Sept 14. However, the week before and after recorded spikes of 11M and 12M ANC unstaked from governance. There is a high chance that this is driven by Apollo vault release but let’s take a look at the next graph to be sure.

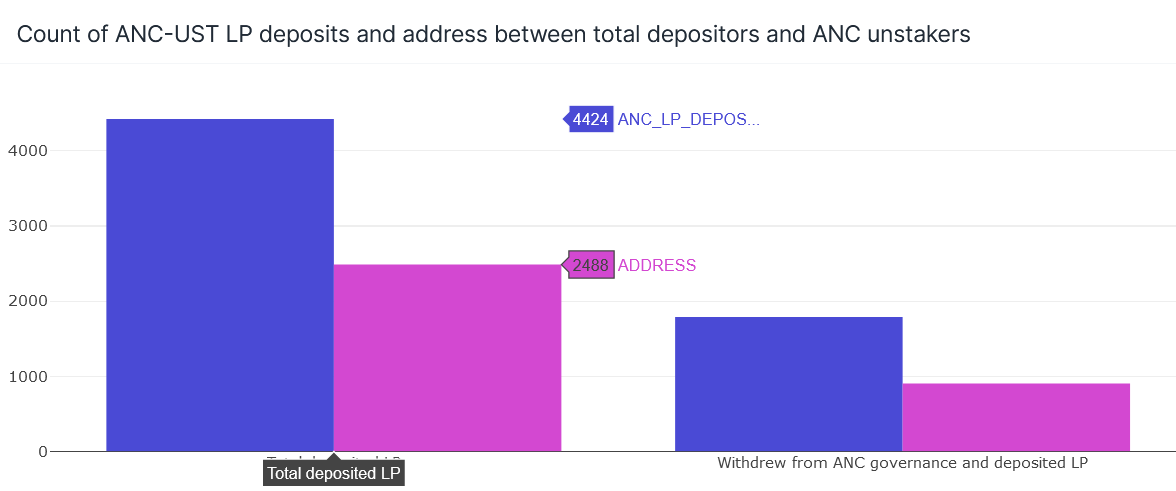

The blue graph represents the number of transactions. The left blue graph means the total number of ANC-UST LP deposits into the Apollo vault while the right blue graph is the same but come from people who have unstaked ANC in September. These transactions turned out to be 40% of the total LP deposits!

Moving on to the purple ones, left purple bar represents total addresses who deposited LP while right purple graph is the number of addresses who deposited into the LP and also unstaked ANC from governance. This works out to be 36% of all addresses who deposited into the vault have unstaked ANC.

We see a very similar trend with MINE whereby a substantial amount of LP depositors actually unstaked the native tokens from governance - 36% of the addresses for the ANC LP.

The most logical explanation for this is people are unstaking MINE or ANC near the Apollo community farming event to provide liquidity using those tokens. Yields that can be earned from the vaults are far better than yields from staking in governance.

Again, because of these evidence, I feel that the Theory 3 on LP deposits for ANC comes from ANC unstaked has some merits.

Conclusion

In conclusion, I posed 3 theories for the origin of deposits in the Apollo vaults and here is the summary for the theories.

Theory 1 on UST:

We first explored the theory where UST is coming from Anchor whereby people are withdrawing the UST parked in Anchor deposits to participate. However, the evidence was not convincing as only 28% of UST withdrawn was deposited into Apollo vaults. 72% of that UST was going somewhere else so Apollo did not seem to be a major driving factor.

Theories 2 and 3 on MINE and ANC LP deposits coming from unstaking activity

These theories seem more plausible as in both cases, deposit transactions from people who have unstaked constitute 40 - 45% of all total LP deposit transactions. One would think that LP deposits come from existing LP positions but the data clearly shows that MINE and ANC unstaking contributed a big portion too.